Undergraduates with Children, 2016-2017

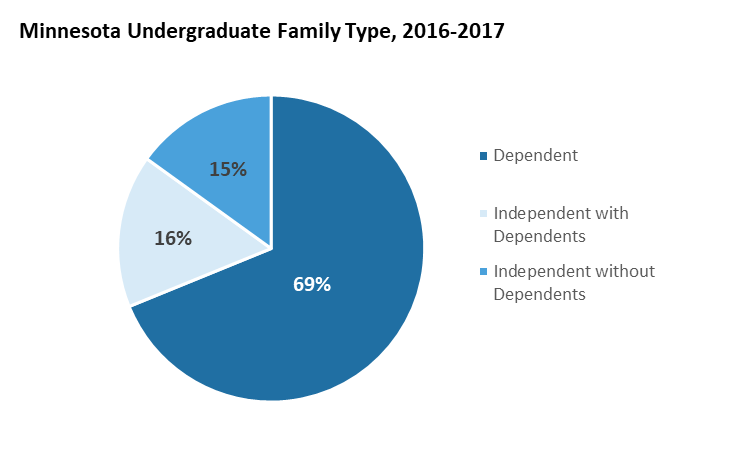

We often think of college undergraduates as young, recent high school graduates. Overall, this is the norm ‐‐last year, nearly 70 percent of undergraduates eligible for the state grant were dependent students, meaning they were dependent on a parent for financial support. However, nearly a third of undergraduates who were eligible for a state grant were listed as independents last year, indicating that they do not rely on another adult for financial support. This generally means that they are adult learners. Often an overlooked group, student adult learners make up a sizeable portion of our undergraduate population in Minnesota. Many are ‐‐in addition to being college students‐‐ parents, spouses, and employees. Last year about half of these students, just over 23,000 in total, were parents with dependent children.

Minnesota Undergraduate Family Type, 2016-2017

Source: Minnesota Office of Higher Education

Age and enrollment of student parents

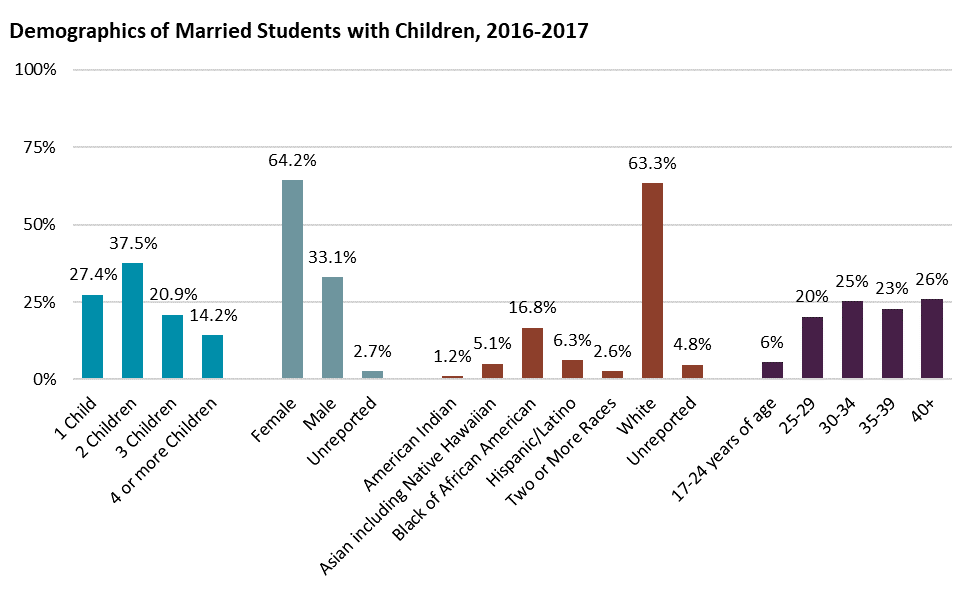

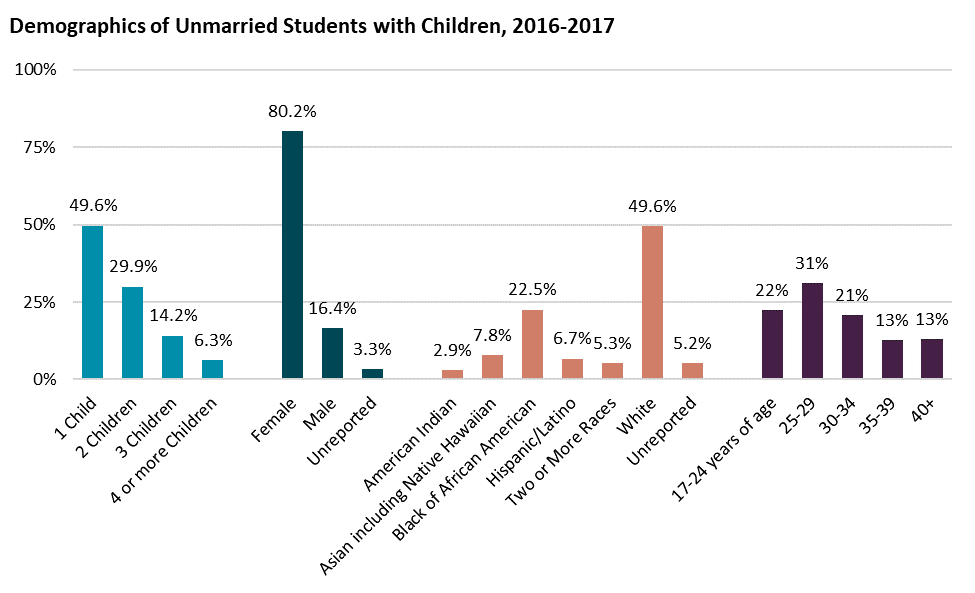

All parents work hard, and student parents are no exception. Most married student parents and about half of all unmarried student parents care for two or more children. Meanwhile, most student parents are older. Nearly two-thirds of all student parents are over the age of 30, and an even greater share of married student parents are over the age of 30.

Many of these older parents face significant hurdles to achieving their education, including parenting demands, work, and ongoing financial obligations. Therefore, it’s not surprising that the majority of student parents attended college on a part-time basis last year, with roughly two-thirds pursuing two-year degrees.

Source: Minnesota Office of Higher Education

Source: Minnesota Office of Higher Education

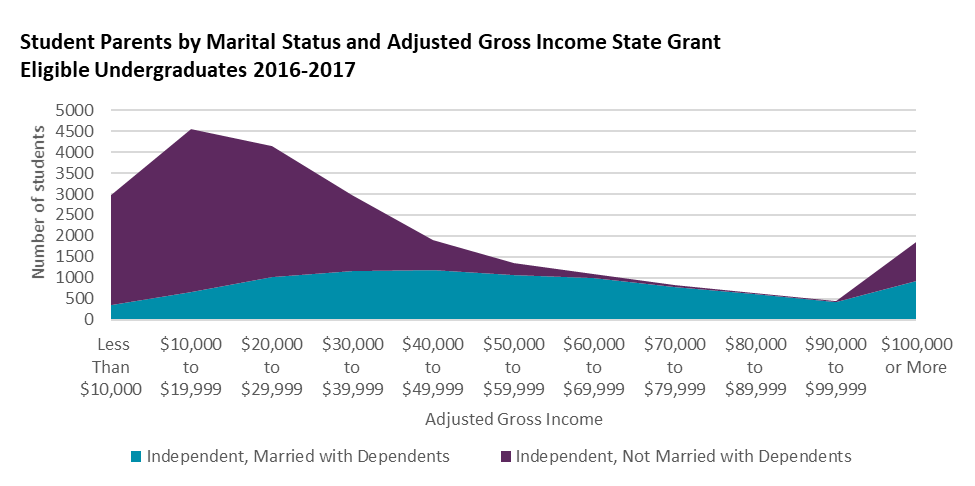

Incomes of student parents

Most unmarried student parents have incomes under $30,000, and nearly 50 percent of unmarried student parents have incomes under $20,000. Two-thirds of unmarried student parents had incomes beneath the poverty threshold. Students in these categories are likely pursuing a postsecondary degree to secure career opportunities that provide ongoing stable income sources.

Source: Minnesota Office of Higher Education

By comparison, the average family adjusted gross income for the parents of dependent students was roughly $92,000. Fewer than 20 percent of households with dependent students had incomes beneath the poverty threshold.

| Family Type | Number | Percent | Average Household Size | Median Age | Median Family Adjusted Gross Income | Average Family Adjusted Gross Income | Percent with Income Less than 100% of Poverty |

|---|---|---|---|---|---|---|---|

| Dependent | 100,296 | 68.8% | 4.17 | 21 | $76,568 | $91,500 | 19.6% |

| Independent, Married with Dependents | 9,320 | 6.4% | 4.30 | 34.00 | $51,864 | $56,776 | 24.1% |

| Independent, Not Married with Dependents | 14,165 | 9.7% | 2.80 | 29.00 | $19,504 | $21,837 | 66.6% |

| Independent, Married without Dependents | 3,215 | 2.2% | 2.00 | 29.00 | $45,372 | $50,472 | 20.0% |

| Independent, Not Married without Dependents | 18,711 | 12.8% | 1.00 | 27.00 | $18,827 | $20,931 | 50.9% |

| Total | 145,707 | 100.0% | 3.59 | 22.00 | $54,578 | $73,657 | 28.5% |

Source: Minnesota Office of Higher Education

About the Data

This analysis identified Minnesota resident undergraduates who completed the Free Application for Federal Student Aid (FAFSA) in 2015-2016 and were eligible for a Minnesota State Grant. When applying for financial aid, students are either dependent or independent.

Independent students are undergraduates meeting one or more criteria (age 25 years and older, married, have dependents/children, veteran, active duty military, homeless, former foster care youth, or other eligible circumstances). Students age 24 and younger and not meeting the criteria for independent status are classified as “dependent”.

The financial aid application data on income and family status was matched to enrollment records to include additional demographic characteristics and enrollment activity.

Note: documents in Portable Document Format (PDF) require Adobe Acrobat Reader 5.0 or higher to view.

Quick Links

- Why College?

- Explore Your Interests & Careers

- Prepare at School

- Summer Academic Enrichment Program

- The Many Ways to Earn Credit for College

- Recommended High School Classes & Graduation Requirements

- Advice for Students with Disabilities

- Succeed as an Adult Student

- Useful College Prep Resources

- Minnesota Goes to College!

- Collecting Data from Minnesota Postsecondary Institutions

- Campus Financial Aid Administrator Resources

- Statewide Financial Aid Conference

- Campus Student Enrollment Reporting Resources

- Ordering Materials for Your Students

- Supplementing Your College Counseling

- Early Awareness Efforts

- Student Homelessness in Higher Education Resources

- Shared Library Resources

- MN FAFSA Tracker

- Campus Sexual Violence Prevention and Response

- Statewide FAFSA Filing Goal

- MyHigherEd

- Online Applications

- About Financial Aid

- What Does College Cost?

- Tips for Lowering the Cost of Higher Education

- Financial Aid You Don't Repay

- Financial Aid You Must Repay (Student Loans)

- Institutional Payments

- Financial Aid You Earn

- Military Service Education Benefits

- Reduced Out-of-State Tuition Options

- Education Tax Benefits

- Public Service Loan Forgiveness

- Useful Online Resources

- Ready, Set, FAFSA!

- Minnesota Paramedic Scholarship

- Data Maps and Infographics

- Educational Attainment Goal 2025

- Minnesota P-20 Statewide Longitudinal Education Data System

- Minnesota Measures

- Student Enrollment Data

- College Readiness & Participation Data

- Degrees, Graduation Rates, Attainment & Outcomes

- Tuition & Fees Data

- Student Health and Safety

- Financial Aid Data & Trends

- Institution and Data Search

- Transfer Students

- Research Reports

- A-Z Data Table Index

- Postsecondary Funding

- Special Student Populations